Get all of the paperwork you need. You’ll most likely will need your tax returns, modern pay out stubs or other types of money verification, lists of assets and liabilities, lender statements and some other documents that explain your money predicament.

Take a second to finish this way and we will be able to give the very best company in your unique disorders and desires.

Common mortgages are the most typical style of dwelling mortgage. They aren’t insured by any federal government agency; as an alternative, they’re funded by conventional banking companies, mortgage finance companies and credit history unions.

Look at factors. Just one lender could charge you mortgage points for a similar interest fee that A further lender will provide you with with no details.

A lot of people are intimidated by the unfamiliar mortgage system they don’t shop close to. That’s a tremendous slip-up which can cost you A huge number of bucks, if not tens of 1000s of pounds.

All three of these mortgage specialists are controlled and accredited. However, In case you are dealing with a loan officer, they may only be registered, not licensed. That doesn’t imply you shouldn’t operate with a registered Skilled; They might be correctly ready to deliver what you will need.

It’s likely a smart idea to hunt for a lender just before you start home-looking, so you have a far better sense of how much you can afford to pay for and regardless of whether you’ll be preapproved. Assess many lenders rather then heading with the initial just one you find.

Bob Musinski has published about a range of monetary-associated topics – which include own and organization financial loans, charge cards and private credit history – for publications including U.

Mortgage desire prices are what it expenses to services your mortgage. Interest is generally expressed every year for mortgages. The existing 30-yr, preset-charge mortgage has an average interest rate of six% or even more.

Mortgage advisors aren’t for everyone. There are some downsides borrowers can face when working with an advisor.

The primary good thing about FHA loans is that they have significantly less stringent qualification specifications than common financial loans. Borrowers by using a credit rating of a minimum of 580 can qualify which has a down payment as little as 3.

Finally, whether to work with a mortgage advisor is a private final decision that is determined by a borrower's specific demands and circumstances. Prior to making a call, it is important to take into consideration each the more info benefits and disadvantages and investigation different advisors to locate the finest suit.

Check with each whether they assistance their own financial loans or promote them, tips on how to get to customer service and what type of online or cellular account obtain they supply.

While there'll very likely be some variation determined by which immediate lenders you select, it is possible to commonly be expecting the online mortgage system to operate equally to applying for any mortgage at a conventional financial institution.

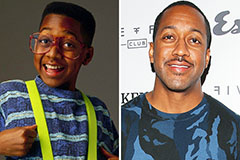

Jaleel White Then & Now!

Jaleel White Then & Now! Jonathan Taylor Thomas Then & Now!

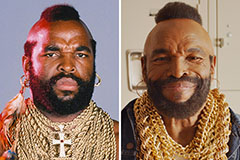

Jonathan Taylor Thomas Then & Now! Mr. T Then & Now!

Mr. T Then & Now! Destiny’s Child Then & Now!

Destiny’s Child Then & Now! Talia Balsam Then & Now!

Talia Balsam Then & Now!